While ice creams enchant taste buds all year round, warm weather is a catalyst for heightened sales. However, for most of 2023, we can agree, the sun hid for most of the season. The narrative of 2023 unfolded with an early heatwave in May, followed by a less-than-ideal summer, only to be redeemed by an Indian summer finale.

Despite the market volume and penetration experiencing the ebb and flow of the unpredictable summer, convenience sector emerged as the resilient victor.1 In navigating these uncertain times, we’ve learnt a thing or two to keep your ice cream sales rocking!

Here are the 5 ice cream trends we’re taking with us into 2024:

Post-Covid, 49% of UK customers find it easier to justify indulgent treats, making it the top driver for ice cream purchases3. The 'treat' factor influences 42% of UK ice cream occasions, and customers are willing to pay a bit more for that extra indulgence, especially in winter!

Handheld ice creams share of the total ice cream market have grown 4.2% in two years4. Ice cream is the 2nd most impulsive category across total Grocery store, making visibility key. POS and highly visible placement of freezers next to the entrance or till points are crucial to drive accessibility.

Did you know that between 2pm and 5pm is the key time of day for selling ice cream? Insights from the Lumina Convenience & Wholesale Market Report 2023 reveal that Treat is key mission for convenience shoppers. Ice cream makes up 37% of the frozen category in convenience making it a destination category. New and exciting treats (NPDs) are driving sales, connecting with people and making these hours the highlight of the day for ice cream lovers.

It’s no secret that the cost of living has tightened purse strings and ice cream is not immune. 25% of consumers are considering spending less on ice creams due to cost-of-living crisis, and the way they are shopping has changed. Offers and promotions are the biggest influencer of ice cream sales, so it’s important to advertise them well.

49% of UK consumers prioritising healthy eating, and nearly two-thirds of parents often worry about the healthiness of their children's snacks2 it's more important than ever to capitalise on this trend3. 30% of consumers would buy more ice cream if they came in smaller formats, so introducing these versions of beloved ice creams and promoting the reduction in fats, salts and sugars is important5. Notably, bitesize ice creams have become the fastest-growing subcategory6!

What does this mean for you as a retailer?

All of this offers a great opportunity for Leisure, convenience retailers & forecourts, as you can easily meet the needs of consumers as their behaviours shift in the months to come. Just make sure you’re ready with the right range and products to give consumers what they’re looking for!

7Nielsen GB Total Coverage (Excl Discounters), 26 weeks to 16.09.23

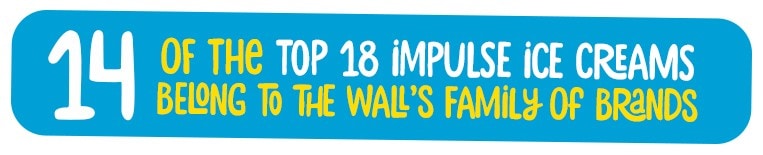

So, you’re already in the right place. From the indulgent ‘True to Pleasure’ Magnum, to Responsibly Made for Kids reformulated ice creams such as Twister and Calippo: we’ve got the right range to meet the needs of your customers.

Checkout out the Best-Selling Impulse Range For Your Store

1. Kantar Data Take Home Ice Cream 52wk 06/08/23

2. Netmums, 2021

3. Mintel, 2023

4. Metrix Lab, 2021

5. Mintel, 2022

6. KWPO, 2023

7. Nielsen GB Total Coverage (Excl Discounters), 26 weeks to 16.09.23